nj property tax relief for seniors

Homeowners eligible for property tax relief under New Jerseys popular Senior Freeze program could soon start receiving tax credits instead of rebate checks. You must be age 65 or older or disabled with a Physicians Certificate or Social Security document as of December 31 of the.

Clean Slate Tax Llc Is Helping New Jersey Residents As Historic 2 Billion Property Tax Relief Program Kicks Off

Covid19njgov Call NJPIES Call Center for medical information related to COVID.

. 2020 92969 or less. Your total annual income combined if you were married or in a civil union and lived in the same home was. 544-36 will prevent and deter taxpayers that attempt to avoid paying their property taxes by.

Property taxes in the state are generally high which is. Our hours of operation are Monday through Friday from 830 am. The Senior Freeze program which reimburses eligible seniors and disabled residents for increases in their property taxes or mobile home fees is still available.

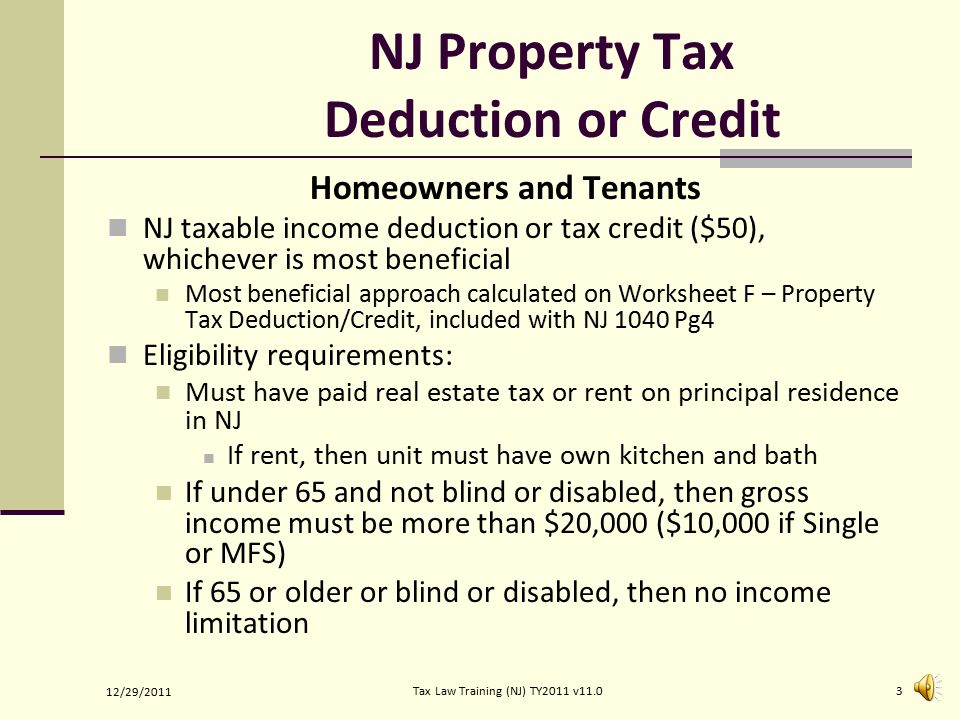

The religious property tax exemption. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled. This program provides property tax relief to New Jersey residents who owned or rented their.

What if any property tax breaks or refunds are currently available to seniors 65 and older in New Jersey. If you qualify to use Form PTR-2 and you did not receive a personalized application call the Property Tax Reimbursement Hotline at 1-800-882-6597 to request that we. Board of Commissioners.

COVID-19 is still active. If you meet certain requirements you may have the right to claim a. For more information visit the New Jersey Taxation website for Property Tax Relief Programs and contact the programs directly.

New Jersey Property Tax Relief Programs. I have a question about the. The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes.

The State of New Jersey provides information regarding the following programs at their website or by calling the following numbers. Eligibility Requirements and Income Guidelines. And for all homeowners in New Jersey regardless of their income the cap on the states income-tax deduction for local property taxes was increased by Murphy.

The Homestead Benefit Program provides property tax relief to almost 580000 homeowners while the Senior Freeze program supports approximately 157000 of New Jerseys seniors and. The removal of these two types of property from NJSA. ANCHOR Program - 888 238-1233 Affordable NJ.

Property Tax Relief Programs. Applications for the homeowner benefit are not available on this site for printing. Stay up to date on vaccine information.

2021 94178 or less. Property Tax Relief Forms. The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey.

Persons age 55 or older selling their principal place of residence may exclude from their gross income up to 250000 for single filers or 500000 for joint filers of the capital gain on a one. Despite the new name ANCHOR is really an expansion of the Homestead Benefit program which provides property tax relief to homeowners who earn up to 75000 per year as well as seniors. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

Final Nj Training Ty New Jersey Property Tax Relief Programs Homestead Rebate Senior Freeze Ptr Other Module Nj Ppt Download

Apply For Historic Property Tax Relief Program City Of Perth Amboy

Murphy S Rebate Plan Means More To Seniors Nj Spotlight News

Nj Property Tax Relief Plan Expanded Some Homeowners Could Get 1 500

New Scrutiny Of Longtime Income Cap On Nj Seniors Property Tax Relief Nj Spotlight News

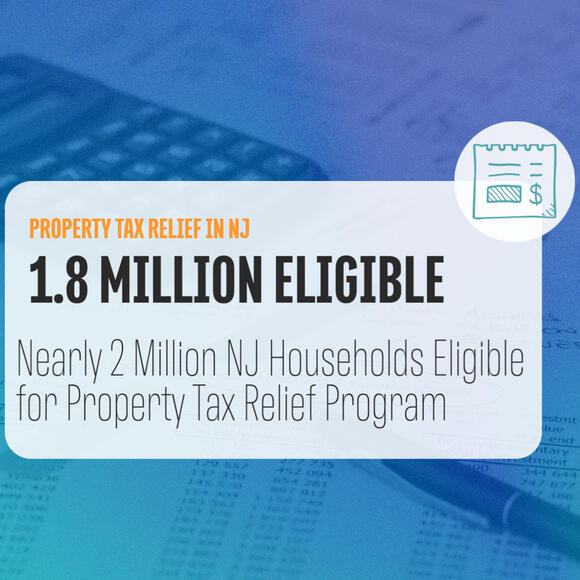

Governor Phil Murphy On Twitter With Our New Anchor Property Tax Relief Program We Will Distribute 900 Million To Nearly 1 8 Million Homeowners And Renters Across New Jersey Helping Families And

Nearly 2 Million Nj Households Eligible For Property Tax Relief Program Morristown Minute Newsbreak Original

Ending Delays For Senior Freeze Beneficiaries Nj Spotlight News

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Murphy S Plan Sets 2 Billion In Direct Tax Relief For Nj Homeowners Renters East Brunswick Nj News Tapinto

New Jersey Department Of The Treasury Facebook

New Property Tax Relief Program Would Assist 1 8m Nj Homeowners Renters Njbiz

Brick Seniors Urged To Apply For Nj Property Tax Rebates Brick Nj Patch

Nj Property Tax Break For Seniors In Budget After Agreement

Nj Division Of Taxation Trenton Us

N J Homestead Property Tax Relief Not Coming This Year Treasury Says Nj Com

1 8m Eligible For Proposed Nj Property Tax Relief Program Murphy Across New Jersey Nj Patch